Rolling Updates on Bitfinex and Distributed Materials

May 23, 2019

Bitfinex has announced that Ampleforth, a Silicon Valley based company, will be the first project launching its IEO platform. We have acquired its press release per below.

Ampleforth (AMPL) To Conduct First IEO on BitFinex and Ethfinex’s

Blockchain Project Launch Platform, Tokinex, in June

SAN FRANCISCO — MAY 23 2019 — Ampleforth (https://www.ampleforth.org/), expected ticker symbol AMPL, announced today it will be the first initial exchange offering to be conducted on Bitfinex & Ethfinex’s token project launch platform, Tokinex (http://tokinex.ethfinex.com/).

Ampleforth’s whitepaper, co-authored by Manuel Ricon Cruz, researcher at the Hoover Institute, introduces the Ampleforth protocol. Further context for understanding the implications of AMPL as a new type of synthetic commodity and economic theory is provided in the accompanying Red Book.

The appeal of digital assets like Bitcoin is that they are uncorrelated with traditional asset groups. But, among large-cap digital assets, there is a high degree of non-diversifiable risk and the price volatility of most cryptocurrencies mimic that of Bitcoin.

“We see Amples as having a near-term utility that naturally dovetails into a much bigger vision, and I can’t wait to see it unfold,“ says Evan Kuo, CEO and founder of Ampleforth. “The Bitfinex and Ethfinex user communities are among the best in the industry, and we are excited to work alongside the Tokinex team for Amples’ exchange debut.”

Ampleforth’s protocol receives exchange-rate information from trusted oracles, and propagates that to holders of Amples by proportionally increasing or decreasing the number of tokens each individual holds according to the magnitude of the exchange rate fluctuations over the previous 24 hrs. For traders, these changes in exchange rate and quantity translate into changes in Ample’s market capitalization. Ultimately, unique trader behavior in response to the protocol’s incentives is expected to produce an asset price with lower correlation to Bitcoin than other digital assets.

“The Ampleforth project is fascinating to us with its refreshing vision to become a unique digital asset and serve as a potential future reserve currency,” said Jean-Louis van der Velde, CEO at Bitfinex. “We believe it can provide a unique volatility profile, uncorrelated to other digital and traditional assets. This uncharted territory makes Ampleforth, and the team behind it, the perfect first project to list on Tokinex and we are excited to provide an opportunity for the community to be a part of it.”

Paul Veradittakit of Pantera Capital says, “Ampleforth is interesting because there’s not another asset like it, so it will likely not be correlated with other large-cap cryptocurrencies. With more traders and enthusiasts entering the ecosystem since the last rise, there needs to be an option like AMPLs, which could reduce risk for the entire space, and potentially attract more institutional interest.”

About Ampleforth

Ampleforth is a digital asset protocol for smart commodity-money funded by Brian Armstrong, True Ventures, Pantera Capital, and Slow Ventures. For more information, please visit www.ampleforth.org.

About Tokinex

Launched in May 2019, Tokinex is the IEO platform of Bitfinex and Ethfinex that brings fair opportunity to participate in curated token projects. It gives qualified participants the chance to contribute to pre-vetted token sales directly from their personal wallet through common crypto assets, and with no personal data or funds held by the exchange. Tokinex uniquely does not require tokens to pay an upfront fee for listing and following a successful capital raise are subsequently listed on the two exchanges as permitted by applicable law.

For further information please contact partners@ethfinex.com.

May 21, 2019

Bitfinex has announced that it will be launching its own IEO platform. We have acquired its press release per below.

Bitfinex and Ethfinex Launch IEO Platform – Tokinex

21.05.2019, 11:00 UTC

Bitfinex and Ethfinex, two of the world’s leading digital asset exchanges, today announce the launch of Tokinex, their new Initial Exchange Offering (IEO) platform.

Tokinex, allows qualified users to discover and participate in curated, pre-vetted token sales from new and exciting projects. The platform has been built with ease of user experience at its core, with KYC for each sale completed using the Blockpass mobile app, and funds directly contributed from personal exchange wallets.

Customer benefits include:

- Access to pre-vetted token projects on transparent and equitable terms

- The ability to contribute existing assets directly from their own exchange wallets and to receive the tokens back into that same wallet, ready for frictionless trading on the secondary market

- Complete confidence that their identity data is secure; Tokinex uses the Blockpass KYC service and does not store personal data after token sales end

- Assurance that all projects go through several layers of technical and commercial due diligence

- Access to comprehensive research reports provided by independent third parties

Unlike on other exchanges, token issuers benefit from no upfront fees for listing, and projects that successfully raise capital on the platform are subsequently listed on both the Bitfinex and Ethfinex exchanges, exposing the token to one of the largest pools of liquidity in crypto.

Jean Louis van der Velde, CEO of Bitfinex and Ethfinex, provided the following statement. “What it means to be an exchange has evolved alongside the maturing crypto market. It has become an entire ecosystem, not just limited to the remit of trading digital assets. Tokinex brings the opportunity for anyone to participate in quality token sales in a fair environment, and for tokens to gain exposure to Bitfinex and Ethfinex users with no upfront cost.”

The first token sale on Tokinex will be announced on the 23rd May, with customers able to start verification the same day. This token sale will start at 13:00 GMT+1 on the 13th June. To participate in the first offering, users simply log-in or sign up, get verified via the BlockPass app, and then contribute the desired assets when the sale opens.

Head to http://tokinex.ethfinex.com/ to get started today.

ENDS

For further information please contact partners@ethfinex.com

Tether partly backed by bitcoin, court transcription reveals: As detailed in court documents obtained by The Block, Tether admitted to using some of the cash reserves meant to back its stablecoin to purchase bitcoin, among other assets. http://bit.ly/2M4BJdq

May 11, 2019

Zhao Dong, founder of Renrenbit announces on Chinese social media platform Weibo that pre-order closed successfully

21 million LEO raised through RenrenBit

May 10, 2019

RenrenBit is taking Bitfinex’s IEO token LEO pre-orders until May 11th

Bitfinex’s parent company has received $1 billion in hard and soft commitments for its exchange token sale, according to a shareholder involved in the process. As reported by Coindesk

May 9, 2019

Quick inter-week update on Bitfinex: shareholder Zhao Dong says in Wechat that IEO will no longer take place as private placements for the $1bn LEO tokens has filled the round.

Giancarlo apologizes to the Chinese citizens who wanted to participate in the IEO in a chat with Zhao. Separately, Bitfinex has also issued its own white paper yesterday.

—–

And since the trending topic of Tether and Bitfinex news, we’ve been approached by multiple readers on this topic: How do people in China actually get their hand on cryptocurrencies? What channels do they go through? We have come up with a quick FAQ guide on how citizens in China actually trade cryptocurrencies- the processes, the exchanges, and wallets. Let us know if it’s helpful.

May 8, 2019

Bitfinex has released its whitepaper on its website.

May 7, 2019

Update from the Global Coin Research Twice a Week Newsletter

Register your email ??to get more

What’s happened with Bitfinex around the world:

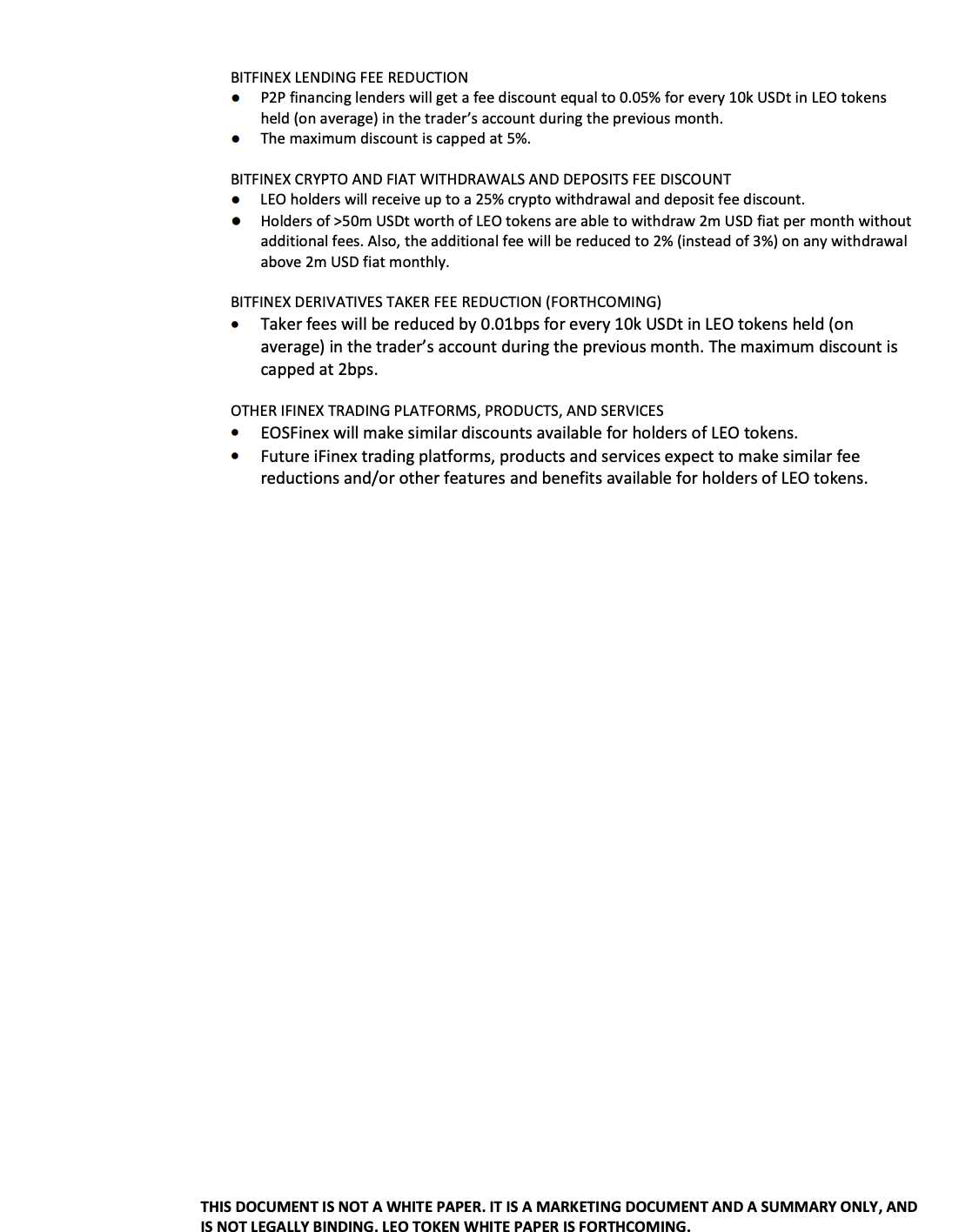

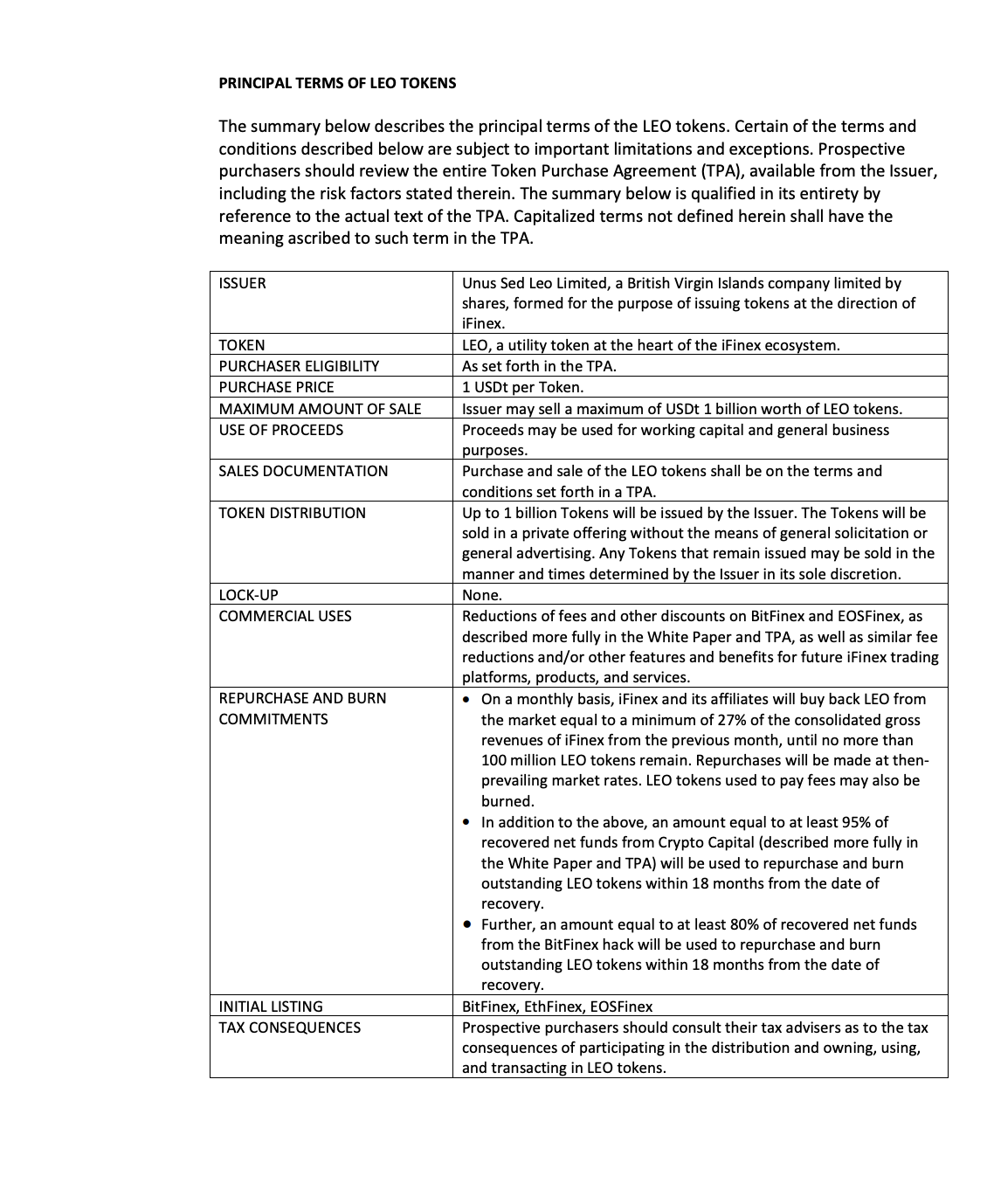

Bitfinex is eyeing a $1Bn raise through an Initial Exchange Offering in its new native token LEO sale through USDT. Here are the terms for LEO in English and other distributed materials that Global Coin Research accumulated. Some research firm also set out to compare BNB and LEO.

Zhao Dong, a Bitfinex shareholder and also crypto whale and investor from China, has taken the opportunity to create his own token issuance platform and wallet called Renrenbit to start taking pre-orders for LEO. Zhao describes it as “HD+Multisig+OffChain wallet + P2P lending service + OTC service”.

Separately, in a new filing, Bitfinex attorneys outlined a number of arguments for why a preliminary injunction secured by the New York Attorney General at the end of April should be canceled or modified. They emphasized on Bitfinex’s actions: “Neither of these amounts to fraud.”

In trading, Diar highlighted that arbitrage opportunities reached as high as 5% for traders willing to jump a few hoops entering and exiting their Tether positions on Kraken, one of the only exchanges to have a USDT/USD pair. And lastly, from some of the folks The Block interviewed, investors echoed that there aren’t that many other stablecoin options besides Tether. We’ve been saying this before, so it looks like IEO will proceed…

THROWBACK

In 2018, I tried to draw some parallels between Wechat Pay and Tether

May 6, 2019

A comparison between Binance Coin and LEO issued by Bigbit Research

May 5, 2019

LEO’s pre-sale has begun on Renrenbit in Chinese and English

May 4, 2019

Bitfinex’s LEO Sales Terms

May 3, 2019

Update from the Global Coin Research Twice a Week Newsletter

Register your email ??to get more

A quick update on Bitfinex and a search for liquidity in this market

This past week, I’ve spoken to numerous people about Bitfinex from the East and West, and there has been a stark contrast in views between the parties.

For one, I was told by the Chinese exchange teams (in this case, I’m referring to Chinese-run exchanges that may or may not be headquartered in China) that when many of the exchanges originally launched in China, they all went to Giancarlo and the rest of the Bitfinex exec team to borrow Tether.

And as many of our readers already know, for crypto traders in China, the most common way for Chinese citizens to enter the crypto market has been through USDT. Because of the ban on crypto exchanges in China, these citizens would go through the firewall, and buy USDT with Chinese Yuan through a customer to customer OTC exchange. They would then use USDT to trade into other altcoins. Similarly, when traders exit the market, they would use USDT to exit as well. Checkout this simple youtube video to see how it’s done.

And by having USDT available from the getgo, the Chinese exchanges would be able to immediately bootstrap liquidity. This was how Huobi originally got started, essentially borrowing USDT from Tether.

And as a result of these partnerships that began very early on, the relationship between Tether, USDT and many of the Chinese exchanges have become very difficult to untie. And now at this timing in the market, we are also seeing a number of Western projects that have been building in the last few years are looking to do a public sale or launch their tokens. These Western projects have relatively better technology and teams on average than the Chinese projects, but they are looking for the same thing as everyone else- liquidity and distribution, which is currently limited in the US.

As a result, these projects too are turning to these Chinese exchanges. For example, one of most touted crypto companies that came out of Silicon Valley last year, ThunderToken, is working with Huobi’s IEO platform, Huobi Prime Lite, to officially launch on May 9. In the past, the Chinese exchanges dominated in liquidity and trading volume, but now, we are seeing also western projects willingly onboarding themselves onto these exchanges and working with them.

This, unfortunately, means that this ecosystem built around USDT is growing by the days, and to me, any large players who try to disrupt and bring down this ecosystem will likely hurt themselves. Even though I don’t have any endorsement for Tether and their management team, I realized this will be an increasingly messy or almost impossible scam to unfold.