A Quick Guide to Asia Market Entry – China, Korea, Japan, Singapore, Thailand and India

“I am interested in learning more about Asia, but I am not familiar with the region and I don’t know how to think about the countries. Where do I start? Which countries should I look into? They are all so different culturally or on a regulatory level.”

Lately, I have spoken with a number of US and English-speaking Crypto projects who are looking to go to market in Asia. 2 primary reasons -1) there are a high number of crypto-aware individuals in Asia that could become potential holders of tokens and participants in the projects’ networks and, 2) given the uncertainty of regulations and potential risk of operating in the US, these projects are looking to build out their Asia presence as a hedge to their business.

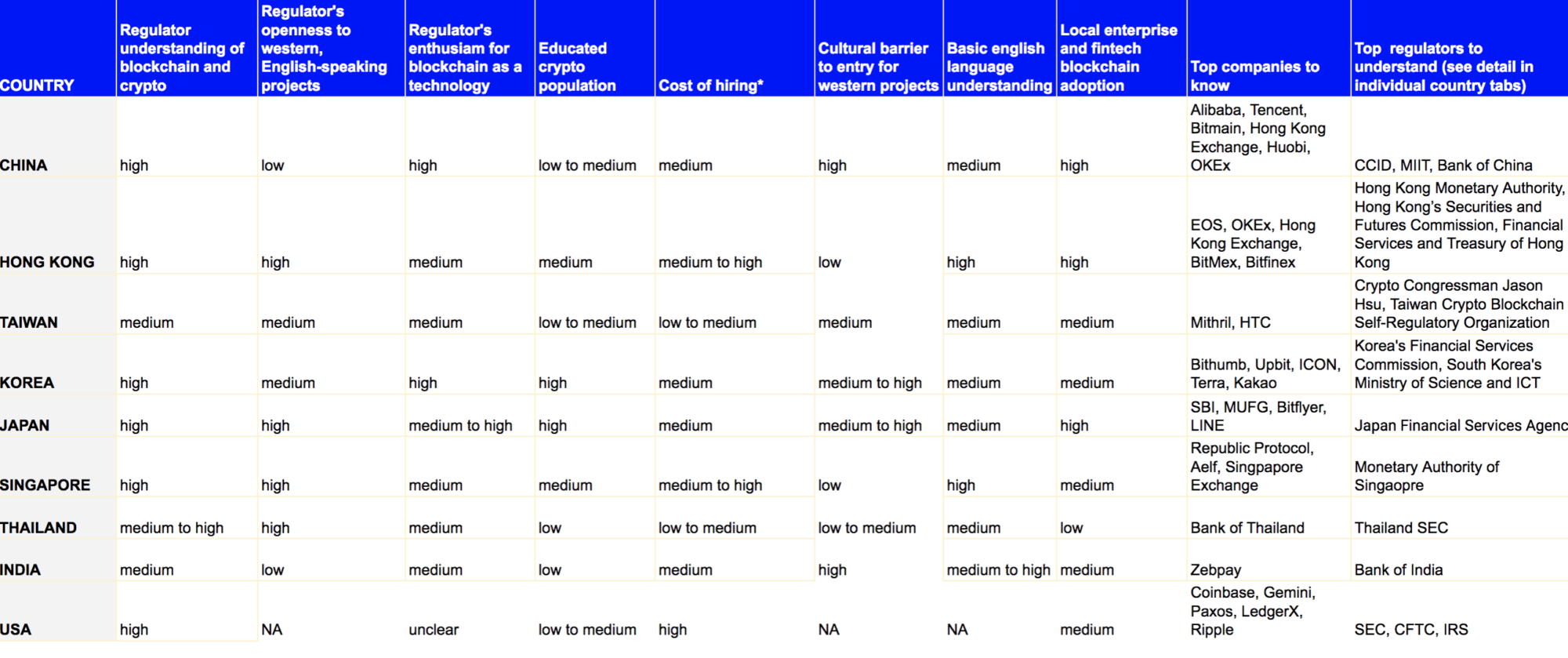

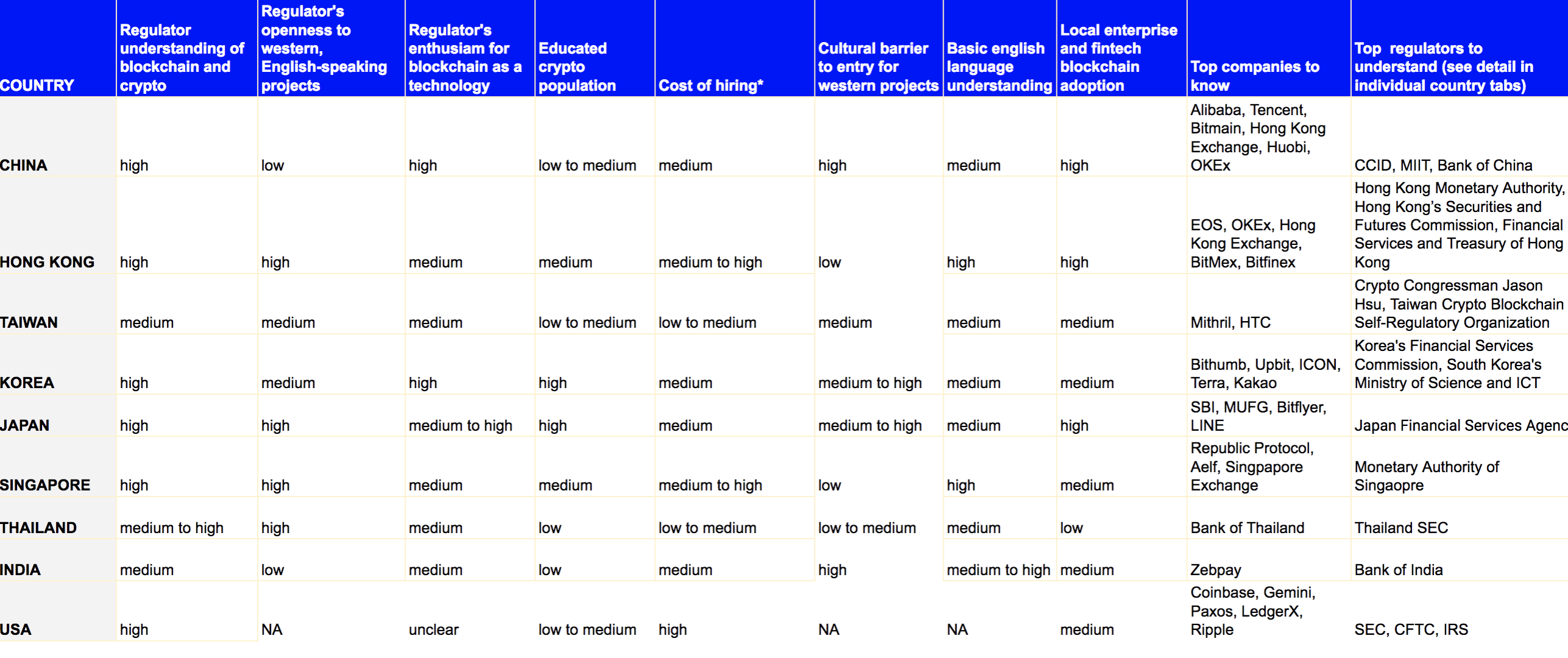

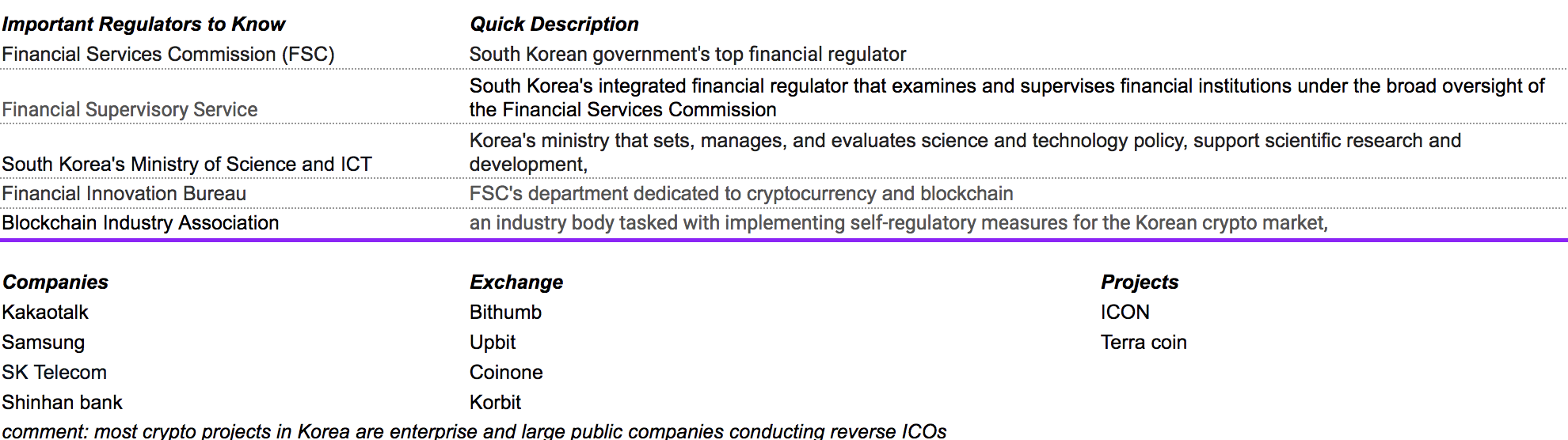

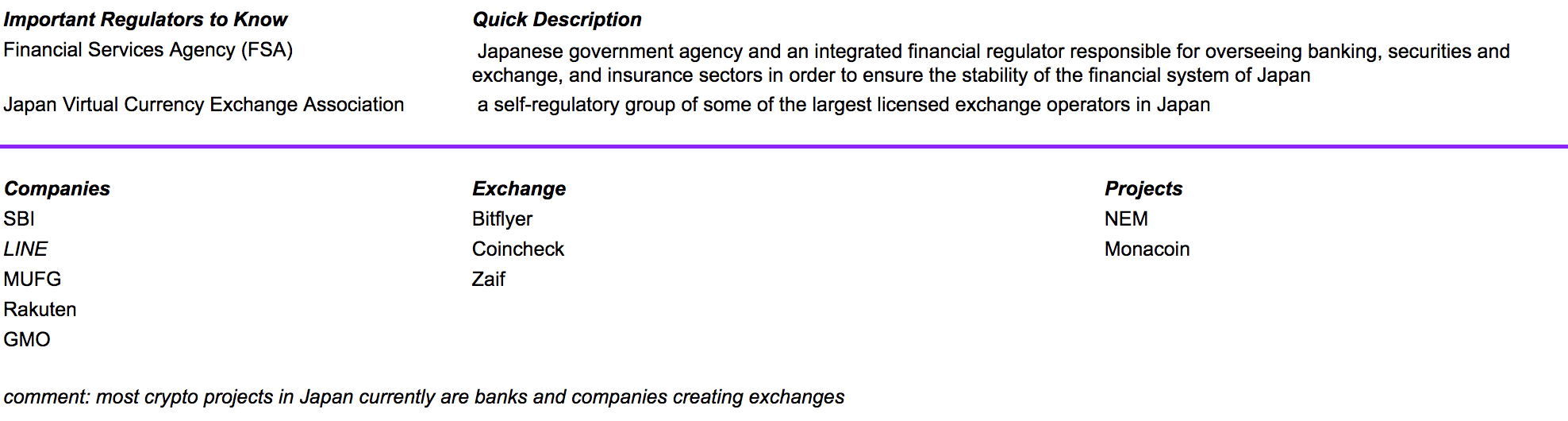

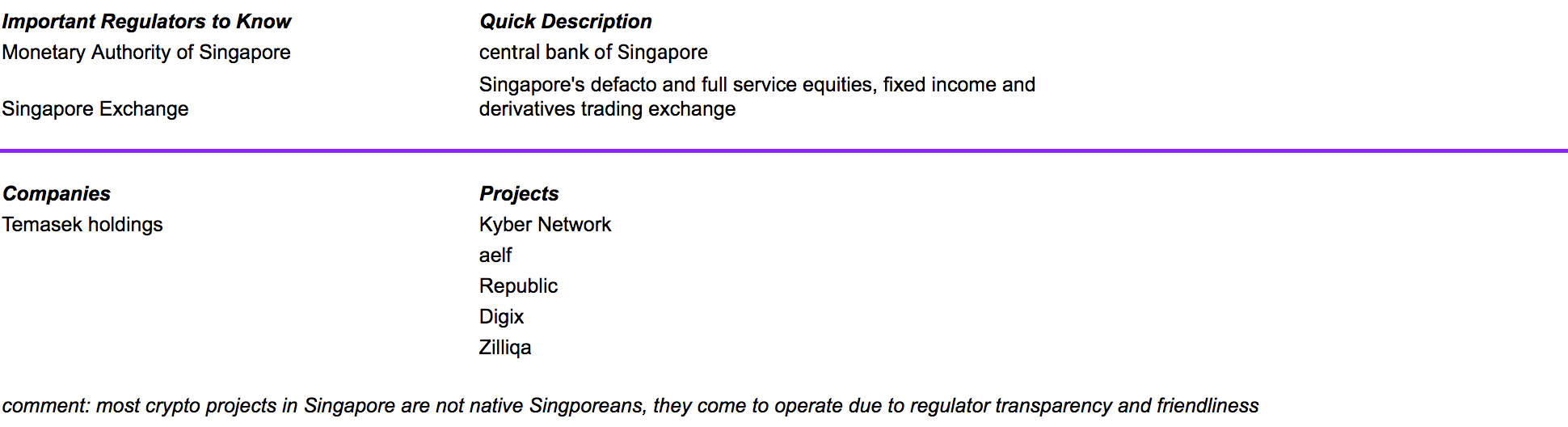

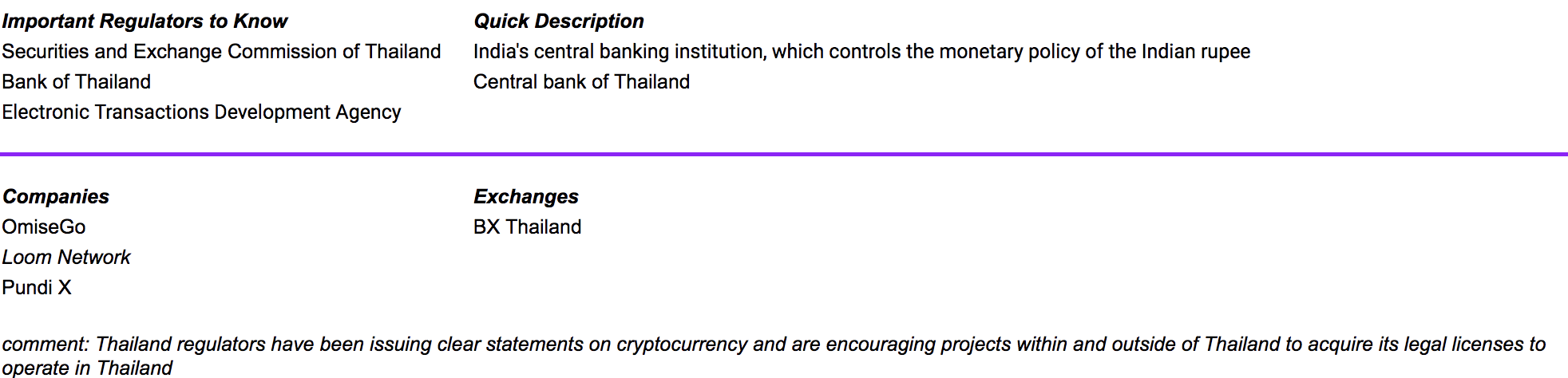

Here’s the quick chart that I’ve made to allow individuals to understand what is happening in each of the countries and their general sentiment towards crypto. We break it down by country- China, Korea, Japan, Singapore, Thailand, India and USA.

The Excel version is here.

Additionally, each country has its own tab and lists out all the important regulators and companies involved in Crypto in that country.

Here is the written form of the quick guide to Crypto regulators and companies by country:

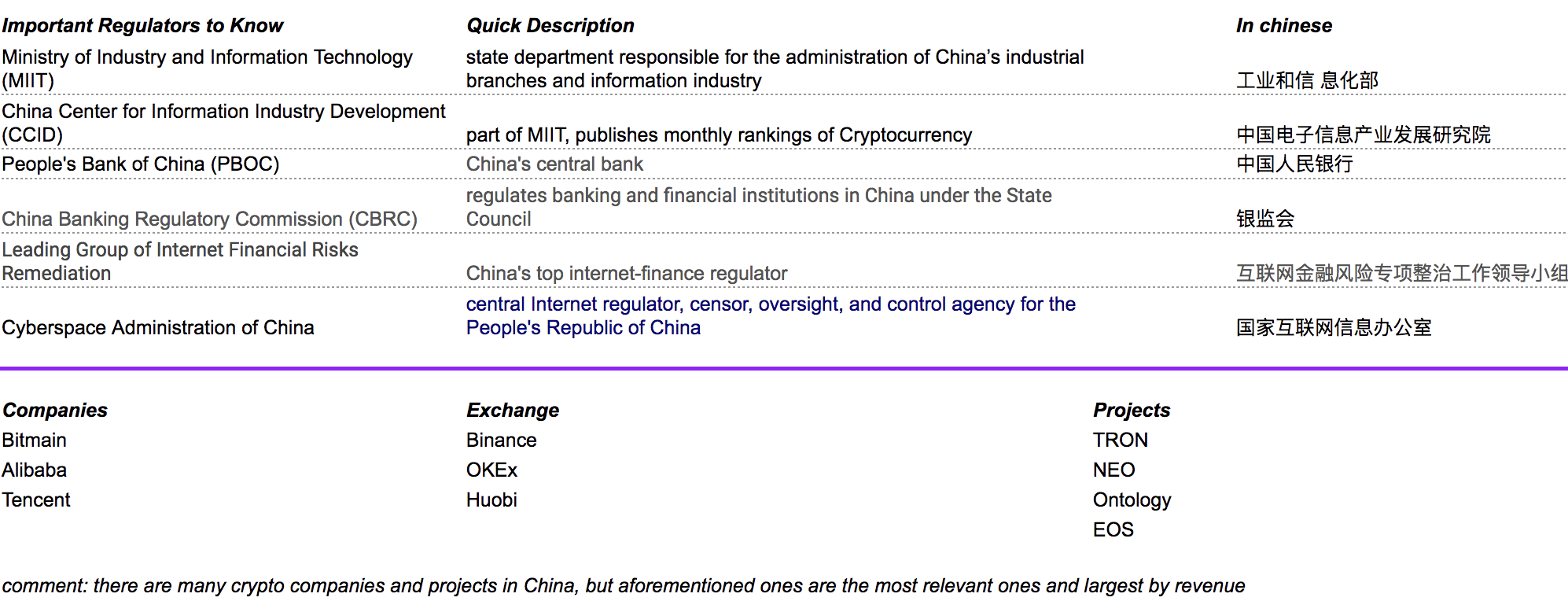

CHINA

Overview: China does not recognize cryptocurrencies as legal tender and the banking system is not accepting cryptocurrencies or providing relevant services. The government has taken a series of regulatory measures to crack down on activities related to cryptocurrencies for purposes of investor protection and financial risk prevention. Those measures include announcing that initial coin offerings are illegal, restricting the primary business of cryptocurrency trading platforms, and discouraging Bitcoin mining. In the meantime, China’s central bank is reportedly considering issuing its own digital currency.

Source: Library of Congress

Approximate timeline of the development of Chinese crypto regulation:

December 2013: The People’s Bank of China issues a warning notice on the risks of Bitcoin, and prohibits all crypto operations for financial institutions

December 2016: The Chinese government adds blockchain technology to its five-year technology plan

June 2017: The People’s Bank of China begins testing a prototype state-backed digital currency — the Bank sends several transactions between it and some of the country’s commercial banks.

September 2017: The Chinese government imposes regulation banning all Initial Coin Offerings (ICOs) and crypto-to-fiat exchanges

January 2018: The Chinese government imposes regulation banning P2P sales and over-the-counter markets

February 2018: The Chinese government blocks access to foreign crypto exchanges and ICO websites

May 2018: President Xi Jinping makes a speech about the importance of pursuing technological research and mentions blockchain amongst revolutionary technologies such as artificial intelligence and the Internet of Things.

May 2018: China Center for Information Industry Development (CCID) Research Institute of the Ministry of Information and Technology releases the world’s first technology-focused public blockchain assessment index placing Ethereum as the number one contender.

May 2018: CCID Research Institute of the Ministry of Information and Technology announces that a committee is being set up to establish a national standard for blockchain, with an expected completion date at the end of 2019.

June 2018: China Central Television hosts a one hour special on blockchain technology with participants from the Chinese government; broadcaster touts blockchain as having an economic value “10 times that of the internet.”

June 2018: China Center for Information Industry Development (CCID) Research Institute of the Ministry of Information and Technology releases an updated public blockchain assessment index placing EOS in front, knocking Ethereum off the top spot.

SOURCE: https://hackernoon.com/navigating-crypto-regulation-china-fbae88697a21

KOREA

Overview: South Korean government officially legalized Bitcoin service providers to facilitate payments, transfers and trades back in July 2017, causing significant growth in the demand for cryptocurrency trading in the country. By mid-2017, the local exchange market already processed over 14 percent of global Bitcoin trades, being the third largest market behind the U.S. and Japan. In December 2017, the government notoriously banned anonymous trading on local exchanges. In January 22 this year, the South Korean government also announced a substantial tax levied on local crypto exchanges.

JAPAN

Overview: Since April 2017, cryptocurrency exchange businesses operating in Japan have been regulated by the Payment Services Act. Cryptocurrency exchange businesses must be registered, keep records, take security measures, and take measures to protect customers, among other things. Cryptocurrency exchanges are also subject to money laundering regulations.

SINGAPORE

Overview: Since 2017, Singapore Monetary Authority has published a “Guide to Digital Token Offerings” in which they explain in a very clear and detailed way the regulatory framework of digital assets. The MAS distinguishes between utility tokens, payment tokens, and security tokens. It continues to provide clear guidelines on cryptocurrencies for companies to operate by.

THAILAND

Overview: Thailand has been relatively transparent and open to accept cryptocurrencies. Bitcoin, Ethereum, Bitcoin cash, Ethereum classic, Litecoin, Ripple, and Stellar are all fully legal in Thailand. In addition to this, Thailand has created a definitive regulatory process for new ICO’s, which is helpful for investors who are growing wary of possible malfeasance in the burgeoning ICO market. The Thai central bank is also looking to introduce one of the world’s first Central Bank Digital Currencies (CBDC), and has already legalized the use of major cryptos within Thai borders.

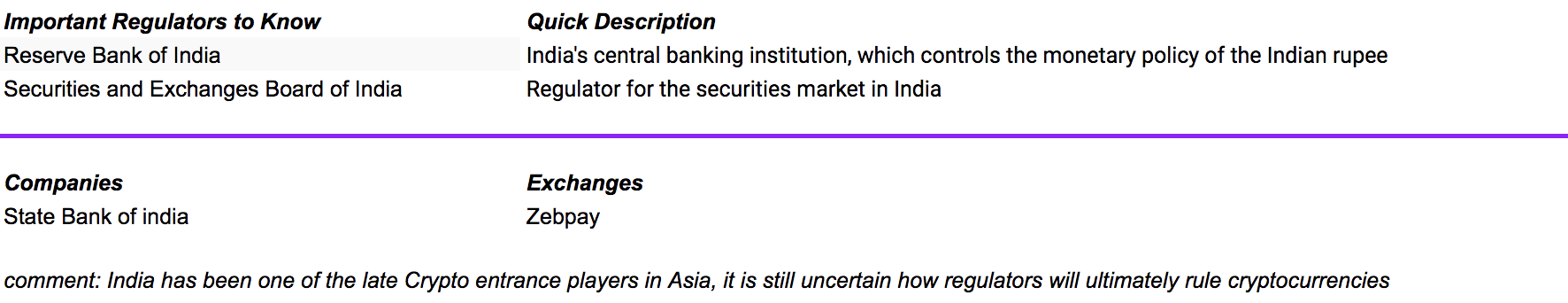

INDIA

Overview: The regulators have been looking into the cryptocurrency ecosystem ever since April 2017 when it set up a panel comprising officials from the finance ministry, the RBI, and India’s market regulator, the Securities and Exchanges Board of India. But earlier this year, India’s cryptocurrency ecosystem was pushed into a corner. The RBI cracked the whip on the exchanges, asking banks to wind up all business relationship with them and investors. Since then, several exchanges have challenged the RBI in the supreme court.