Why does Global Coin Research have a strong focus on Asia?

This topic is split into several posts due to the number of topics addressed. I hope it will be useful for any Cryptocurrency investors looking to invest into Asia-based Crypto companies.

I’ve always known that I wanted to do something with finance and technology. Coming out of college, I became an equity research analyst covering software companies in Silicon Valley. I loved learning about every business I’ve met and heard about. I loved thinking about the technicalities of software and databases.

After I discovered cryptocurrency, I realized how well it fits into my existing interest. I loved thinking about the incentive system and token economics. I learned a new way to value an asset (or not so new). I spent hours diving deeply into the underlying technology. I assessed and compared how different blockchain technologies can change our society in a better way.

Now if you add a China angle to all this, the topic becomes exponentially more complicated and interesting. China operates as its own entity in a lot of ways. It’s story known to the western public to this day is still largely coming from the media and textbooks. However, in the last 2 decades, particularly the last 5 years with the consolidation of power under President Xi Jinping, the country has transformed drastically in the economical and political aspects.

In this first post of the series, I want to provide some background as to what China now wants to do with Cryptocurrency and blockchain technology, from the perspective of the Chinese government. This would hopefully help the audience think about the larger context and the backdrop in which these Asia- based cryptocurrency projects operate in.

China has ambition to catch up to the developing countries and be number 1

Historically, China’s political party has been perceived as conservative and opaque. Even now, the country continues to censor the media and ban access to Facebook and Gmail. This, unfortunately, is how they have decided to manage 1.3bn people. However, they have been quite efficient at it. In fact, China has formed a completely different political and economic infrastructure. If you look at the stats, China’s economic and technological growth has been phenomenal in the last few decades. As the world’se second largest economy, China still sees its GDP rise the fastest more than any other country and has been above 10% until most recently coming down around 7%. Maintaining that kind of GDP growth for a country of 1.3bn people is not an easy feat. And the way China has done so is by continuously and aggressively pushing for urbanization (see an example below on how China built new train tracks in 9 hours). Since 2000, the urbanization rate has increased from 40% to 60% now. This then brings more wealth to the individuals.

https://www.youtube.com/watch?v=yJzPdfGz01A

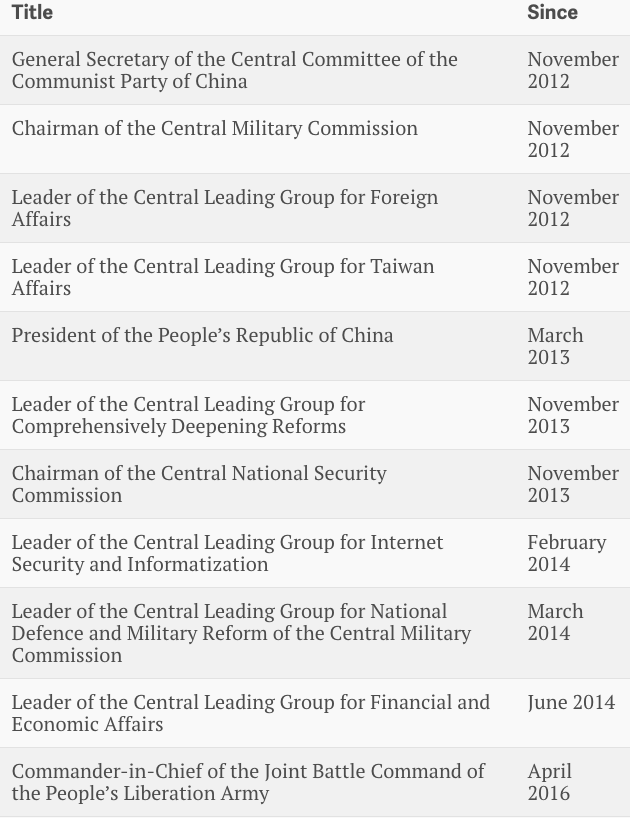

When president Xi came into power, he gradually consolidated his power in the Communist Party of China. In the last few years, he promoted and gave power to his closest advisors. No China president has ever gathered so much power before and people have called him another “Mao”. See the number of titles he has per Quartz below (I found it quite amusing). President Xi’s power consolidation has been scary to some, but it’s been effective and I’d argue even positive. Since coming into power, Mr. Xi has been consistently pushing policies and reforms, primarily in 2 areas- 1) opening up the country economically, 2) focusing on technology developments.

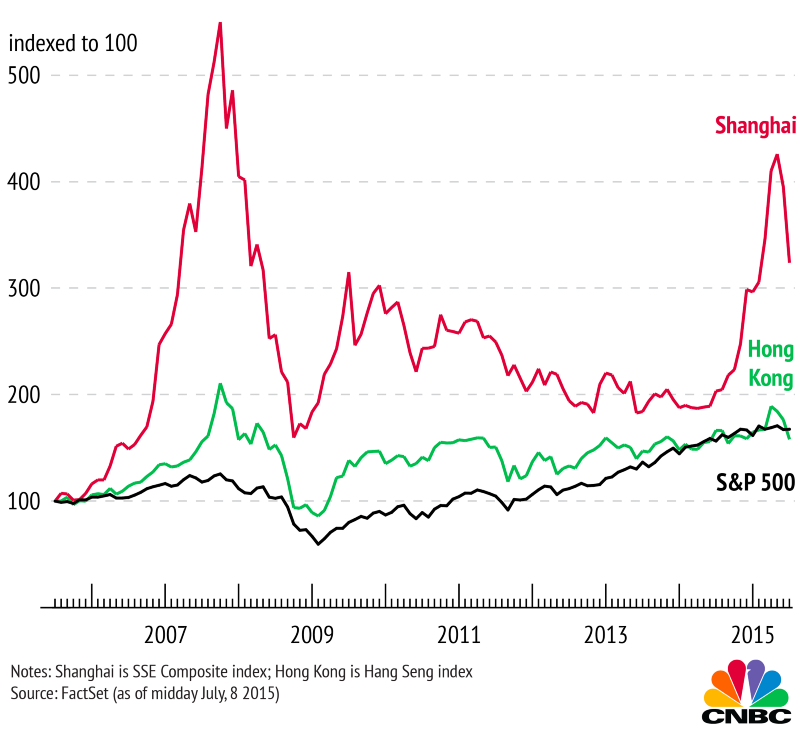

Under Xi, China’s financial markets have opened up more so than ever before. Leadership have become more open to engaging with the west too(the trade wars, unfortunately, is an outcome of that. I wonder whose fault it is?). On the financial market side, for example, MSCI will be incorporating China’s A-share stock market into its Emerging Markets Index for the first time in Jun 2018. Previously, heavy retail ownership (>60% of trading volume) introduced significant volatility to the A-share stock market (sounds familiar?) See chart below. This resulted in the exchanges frequently halting stock trades. But the government has been increasingly be more favorable to institutional ownership, who have been slowly introducing large amounts of stable capital into the market.

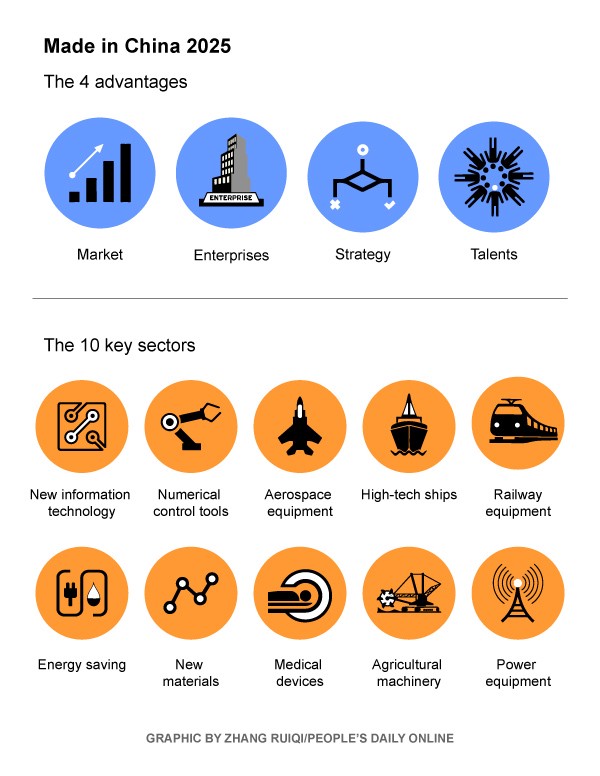

On the technology front, in the last few years, China has been trying to catch up with rivals like the United States and Germany in high-end technology. And in fact, I’d argue they have in many ways surpassed the US, particularly in the consumer app developments. The government has been making a major push with a “Made in China 2025” strategy, which identifies 10 key sectors, including robotics, aerospace and clean-energy cars as areas of focus and development.

So why am I saying all these things?

I want people to understand what China’s government wants. China has become an entirely different country from what folks may have known 5 or 10 years ago. It’s different from what you’ve seeing in the Joy Luck Club and it’s no longer just purely a manufacturing-heavy society. The Chinese government wants China to become a dominant world player and they are firing on all cylinders. They are ambitious to take the country to the next level, to bring wealth to the its citizens and to exert their global influence on the world.

Government Involvement in Cryptocurrency and Blockchain

Regarding cryptocurrency, the Chinese government and regulators are already displaying increasing awareness and sophisticated responses. Despite their initial trading ban that aimed to control capital outflow from the country, the government is turning increasingly more positive towards blockchain technology. On the surface, it appears that blockchain technology in China has been adopted at a faster speed than I’ve seen in any other country.

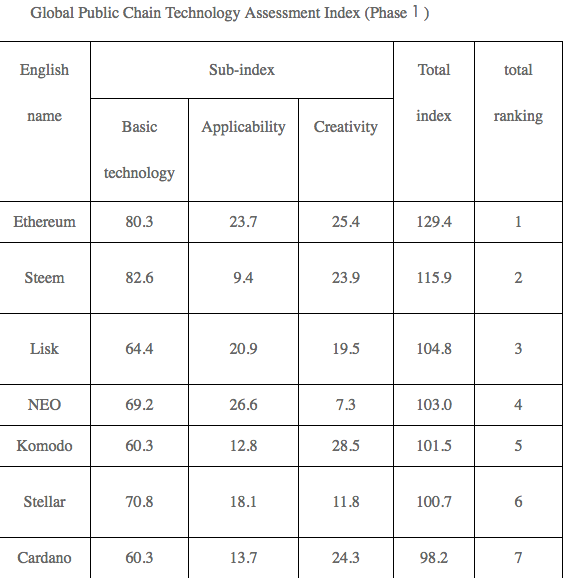

The value of blockchain technologies have been recognized across different leadership and company execs, but there hasn’t been too much implementation on the cryptocurrency side. I believe policymakers’ attitude towards cryptocurrency and blockchains policies will increasingly turn more favorable. Just last week, they have released their own rankings of cryptocurrencies. In their assessment, they’ve reviewed cryptocurrencies by 3 categories: technology, application, and innovation. Ethereum ranks top of the 28 protocols evaluated, Bitcoin ranked13th.

As the policy makers learn more, they will express more opinions on how cryptocurrency and blockchain will be utilized. This is a very important data trend to watch out for as an investor when assessing cryptocurrency projects and blockchain technologies in China. To get the latest on that and other China government and regulator updates, subscribe to my newsletter below for a quick, hassle-free update in your inbox daily.

Thanks for reading folks! The next post will be focused on China’s technology companies and talent.

From Global Coin Research